Answer these questions to see how much you understand the concepts discussed in this tutorial.

1. Joe Cool wants to estimate the cost of going to college full time, he understands that accountants aren’t qualified to calculate the real cost of attending college so he asks Miss Econ to help him. The costs of books, parking and fees are $352 per semester, he attends two semesters a year. Joe also has to give up his job where he currently makes $770/month. What are the explicit costs per year? What are the implicit costs per year? What are the total economic costs per year?

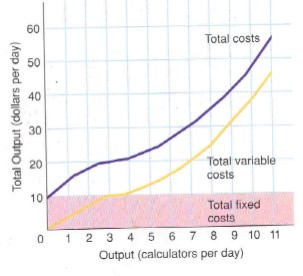

2. Two students want to start a business reselling calculators obtained from eBay, they draw up a business plan, calculate the total economic costs and come up with the following graph:

- Suppose they estimate they can sell 9 calculators per day at $50 dollars total, will they make money? How much? (Estimate) How do you know?

- Estimate the marginal cost of producing the 10th calculator.

- Calculate the Average Variable cost of producing 9 calculators.

- McGrease estimates that the marginal cost of producing its 1,000,000th burger is 65 cents. Furthermore they calculate than they can reduce the average cost of production with the inception of their new cooking machine. Will the marginal cost of producing the 1,000,001th burger be higher or lower? Justify your answer with an explanation.

- A group of college students want to start a band named “Whining Voices” and with the help of one of the members who has taken economics classes at Palomar College, estimate the costs of concerts are as shown on the graph below:

– How many Concerts should they produce to minimize the costs of production?

– Estimate the cost per Concert at this point.

– Estimate how much the band should charge per Concert so they may recover their costs and finance voice lessons. Assume one time voice lessons cost $160.

Do you think this is a viable proposition? Why/why not?

5. Maria decides to quit her $20,000 a year job and open a small store selling high fashion. To start her store, she takes $10,000 out of her savings account. She had inherited this money from her parents. During the first year, her expenses are as follows:

Rent for the Store $12,000

Two Hired Workers $24,000

Clothes $40,000

Accounting Firm $3,000

Electricity $2,000

Insurance $3,000

Maria also works in the store ordering the clothes and doing some selling. During the first year, Maria’s store sold $80,000 worth of clothing.

Her Explicit Costs were $_________________

Her Implicit Costs were $___________________

Her Total Economic Costs were $___________________

Her Fixed Costs were $___________________

Her Variable Costs were $___________________

Her Economic Profit was $___________________

As an economist to be 🙂 – what advice do you have for Maria? Should she stay in business? Quit? Why?